This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Cost Of Living Crisis In The UK

The cost of living crisis in the UK is now in full swing, and people may feel like the government is failing to do enough.

The cost of living is growing at nearly its fastest rate in 4 decades, primarily driven by the rocketing food and fossil fuels prices. Over half of British consumers (57 per cent) have been moderately or severely affected by the cost of living crisis.

We here at Transformational Financial Coaching understand the impact of such increases.

Are Wages Keeping Up with The Rising Cost of Living?

- Pay increases for many Britons aren’t keeping up with rising prices.

- Average wages, not including bonuses, rose by 5.4 per cent in the 3 months to August 2022.

- But considering inflation, wages actually fell by 2.9 per cent.

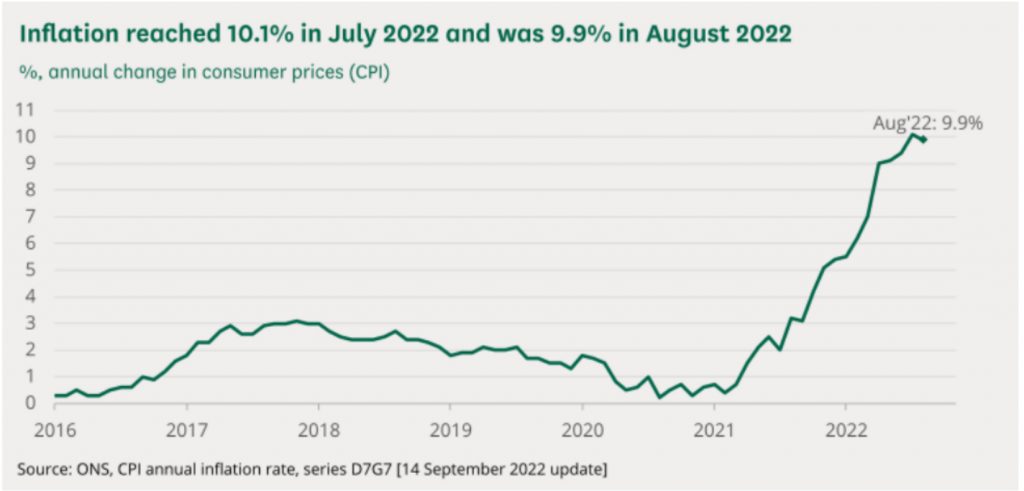

At the time of writing, the UK inflation rate is at 9.9 per cent. What this simply means is that the value of the UK’s currency is dropping as the general price of goods and services surges – hitting your pocket and disposable income.

In other words, the £100 note in your wallet won’t stretch as far as it did this period last year.

With rising food prices, energy bills, water bills, and council tax, young people are feeling the financial strain the most.

Unions argue that wages should reflect the current cost of living, but according to the government, this could push inflation even further.

What’s Causing the Cost of Living Crisis in the UK?

No single factor has led to a financial crisis of this magnitude. It’s a combination of the effects of the pandemic, inflation, rising taxes, debt, the energy price cap lift, and the rising costs of consumer goods and services.

- Food prices have gone up as Russia’s invasion of Ukraine affects grain and sunflower oil production and costs. Ukraine is a major exporter of these agricultural commodities. Changing global weather, distribution issues, and driver shortages are other causes of rising food prices.

- Disruption to global supply chains has triggered a shortage of semiconductors, a vital component in everyday consumer goods.

- Higher interest rates are forcing UK homeowners to make more expensive mortgage payments. Renters are also feeling the pinch, with estimates suggesting that the average rental price has increased by 11 per cent year-over-year. Zoopla says the average single earner loses 37 per cent of their paycheque to rent alone.

- Car owners have had it far from easy recently. Prices at the pump have increased partly due to the war in Ukraine driving up the cost of crude oil (Russia is a major supplier of European gas). While petrol and diesel prices recently fell from record levels, they’re expected to remain high.

- Hiked Council Tax. In April 2022, local authorities raised Council Tax for millions of UK households. The average Band D council tax bill for 2022-23 now stands at £1,966, an increase of 3.5 per cent or £67 on last year’s figure of £1,898.

- Due to the knock-on effect of the pandemic, the Ukraine-Russia war and economic uncertainty, Brexit has had a more significant impact than, possibly, the separation from the European Union would otherwise have had. The economy feels the sting with less economic buffer available.

How Are People Coping?

Britons have employed some clever tactics to try and cut down their monthly expenditure.

These strategies include:

- Driving less

- Socializing less

- Taking shorter showers

- Carrying packed lunch to work

- Buying generic instead of brand-name items

Tips to Help You Weather the Cost of Living Crisis

No magic wand will certainly end the cost of living crisis. There are, however, some cost-free strategies that could make a meaningful difference to your household budget’s bottom line.

- Check if you’re paying excess council tax on your property. Council tax bands’ system is full of errors, and it’s common to be assigned the wrong band. This guide breaks down how to see if you’ve been paying too much, challenge your band, and ask for a rebate.

- Check your benefits or grants. Working families, low-income households, and the disabled may all be entitled to different benefits. A benefits calculator will help ensure you’re receiving your due benefits.

- Take advantage of the marriage tax allowance. If you’re not using your personal allowance, you might be able to transfer up to £1,260 to your spouse or partner, thereby slightly reducing the tax they pay.

- Check to see if your house has a soakaway. Few property owners know this, but if you have a soakaway and your wastewater isn’t going back into the grid, you’re eligible for a cost reduction on your bills.

- Plan your meals. Apps like No Waste and nosh let you document the food and groceries in your pantry, sort them based on expiry dates, and plan meals to reduce waste.

- Still on foods, apps like Olio and Too Good To Go connect you with locals and restaurants that want to share unwanted food and household items.

- Instead of making hefty payments in the name of credit card balances, move your balances to a zero per cent balance transfer card. Other ways to deal with credit card debt include debt consolidation, debt settlement, and looking into debt forgiveness programs.

If you still experience difficulty with your finances after using these tips, get in touch today to speak with one of our experienced financial or career coaches.